Origin of investments

Invest in Serbia means investing funds in order to achieve financial profit. Direct investments amounted to EUR 4,522 million in 2023, according to preliminary data from the National Bank of Serbia, representing a growth of 2.0% compared to 2022.

The largest foreign investors in Serbia, in terms of the number of projects, are foreign investors from Italy. In second place are investors from Germany with a total share of 16,5 % in the total number of projects. In seventh place are investors from Austria with a share of 3,7 %.

In terms of investment value, however, the leading investors in Serbia are companies from Germany. 21,4% of the total value of investments in Serbia comes from German companies. Companies from Austria occupy sixth place.

According to the National Bank of Serbia’s latest publicly available data by country, which refer to the first three quarters of 2023, the largest inflow of foreign direct investments to Serbia was recorded from European (68.1%) and Asian countries (30.2%).

Observed by country, during the first three quarters of 2023, the largest foreign direct investments in Serbia came from China (EUR 818.4 million), the Netherlands (EUR 622.5 million), Great Britain (EUR 217.4 million), Austria ( 215.9 million euros) and Germany (158.6 million euros), while it should be borne in mind that considerable investments come from the Netherlands and because some foreign investors realize their investments from subsidiaries in the Netherlands due to tax incentives, even though the headquarters parent company in another country.

Invest in Serbia – Advantages

Interest for an invest in Serbia has been increasing for years. The main reasons for an invest in Serbia are:

- Economic reasons

- Tax incentives

- Geographical position

- Climatic conditions

- Good visa regime in Serbia.

Geographical position

Serbia is a Balkan-, Pannonian-, Danube-, Southern- and Central-European country. Serbia is situated in the middle between Turkey and Germany, Spain and Russia, Greece and Poland. As a continental European state, Serbia is a corridor for travelers and goods. The part north of the Sava and Danube rivers is located in the Pannonian plain, and in this way Serbia is connected with Central and Western Europe. The Danube connects ten European countries.

The favorable natural-geographical position of Serbia represents a comparative advantage for the development of land, river and air transport and enables the attraction of transit traffic. In addition to constant investments in land and river transport, Serbia does not lag behind in investments in air transport and currently has international airports in Belgrade – Nikola Tesla, Niš – Tsar Constantine and in Kraljevo – Great Morava. More about this topic can be found in our blog text Moving to Serbia.

Climate conditions

Based on the influence of climatic factors and the state of climatic elements, the following types of climate are distinguished on the territory of Serbia:

- Pannonian-continental climate – very hot summers and cold winters, spring and autumn are short. Precipitation is low and ranges from 500 – 700 mm. The most frequent winds are northerly and gusty.

- Temperate continental climate – moderately warm and humid climate up to 800 m above sea level. Summers are moderately warm, winters moderately cold. The amount of precipitation is between 800 – 1000 mm.

- Mountain climate – long and cold winters, short and fresh summers, spring and autumn are less expressed. The amount of precipitation increases from 1.000 to 1.500 mm.

Good visa regime

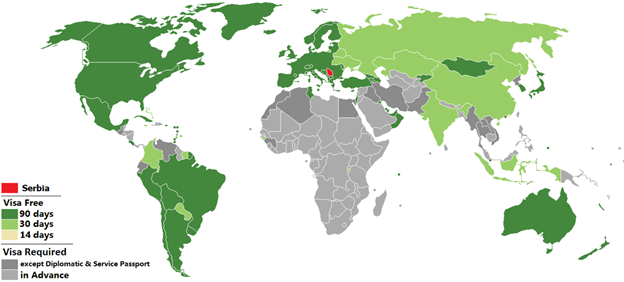

For 148 countries around the world, Serbian citizens do not need a visa or can easily obtain one upon arrival. If countries to which one can travel with an easily obtained business visa are added to this list, the total number of countries is 158. This is certainly a good reason to invest in Serbia in light of the increase in economic barriers between countries.

The visa regime for entering Serbia is shown on the following figure:

Economic reasons

According to the report of the Statistical Office of the Republic of Serbia, the average net salary in Serbia for employees is about 900 euros. The minimum net salary that an employee in Serbia has for 40 hours of work per month is about 550 euros.

The most important economic factors for an invest in Serbia are:

- Economic development

- Transportation

- Agglomeration

- Urbanization

- Human capital

- Labor costs

- Government and integration policies.

Invest in Serbia – Tax incentives and incentives of social contribution

Employer – legal entity, entrepreneur, flat-rate entrepreneur or entrepreneur farmer, who hires a new person, has the right both to reimburse part of the paid income tax, and of social contribution for a newly-employed person. A newly employed person is a person with whom the employer has concluded an employment contract in accordance with the Labor Code, who has applied for compulsory social insurance in the Central Register of Compulsory Social Insurance and who has been registered with the National Employment Service as unemployed for at least six months without interruption, or the person who has been a trainee for at least three months.

The employer is entitled to reimbursement as follows

An investor i.e. employer is entitled to a refund as follows:

- 65% of the income tax and social security contributions paid if he has established an employment relationship with at least one and no more than nine newly hired persons;

- 70% of the income tax and social security contributions paid if the employer has established an employment relationship with at least 10 and no more than 99 newly hired persons;

- 75% of the income tax and social security contributions paid if he has established an employment relationship with at least 100 newly hired persons.

An employer who employs a person with a disability for an indefinite period of time in accordance with the “Law on the Prevention of Discrimination against Disabled Persons” and for whom he proves the disability with appropriate legally and medically valid documents is exempt from the obligation to pay the calculated and suspended income tax and social security contributions for a period of three years.

Employers – legal entities divided into micro and small enterprises within the meaning of the Accounting Act, as well as an entrepreneur, a flat-rate entrepreneur or an entrepreneur who establishes an employment relationship with at least two new persons, are entitled to a refund of 75% of the amount of income tax and social security contributions paid for a newly hired person.